Keyword search

Hong Kong Insurance Claims Process, Required Data, and Frequently Asked Questions

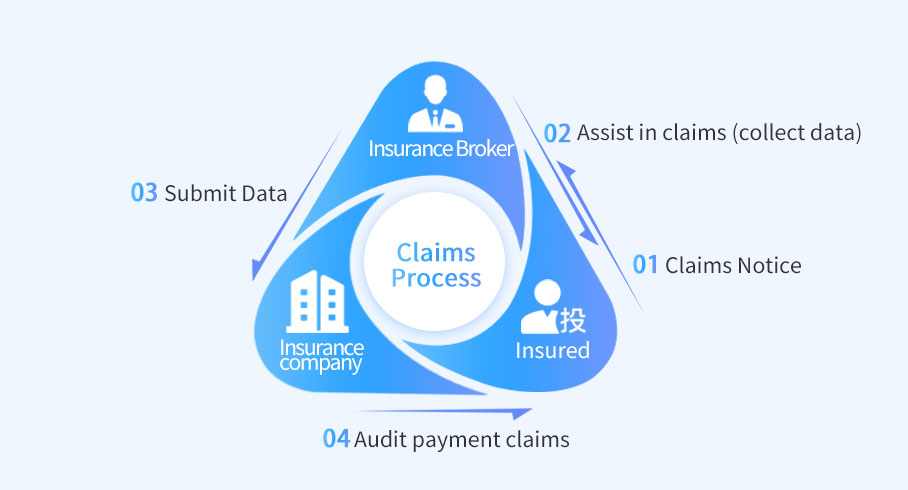

01. Hong Kong Insurance Claims Process

No matter what type of health insurance you purchase, the basic claims process is as follows!

Step 1: Notify the agent/insurance company

The most important step is to notify your agent/insurance company first and apply for compensation from the Hong Kong insurance company, providing detailed reasons to the insurance company.

Step 2: Collect data.

Request the required document claim list from the agent/insurance company. Collect data according to the checklist, and the agent will instruct you on how to fill out the form and what areas to pay attention to.

Step 3: Communicate with the hospital/doctor and assist in filling out medical related information

Doctors from Shenzhen New Frontier United Family Hospital will assist in filling out application forms and collecting claims data for clients

Step 4: Submit data and wait for the insurance company's review and payment of claims

After all the materials are prepared, you can take photos and send them to the agent for confirmation to prevent missing data; Afterwards, if there are no issues, claims data can be submitted through paper versions or various insurance company applications (most insurance companies require customers to complete it within 90 days from the date of diagnosis). Waiting for review and claim collection

02. Hong Kong Insurance Claims Method

Customers can choose two claims methods:

1. The customer directly sends the claim data to the broker, who then submits it to the insurance company.

2. Customers can directly contact the customer service of the insurance company and send the claim data to the insurance company or through APP Upload claim data

03. Hong Kong Insurance Claims Data

The claim materials required for different types of insurance are different. The necessary materials include insurance contract certificate, claim application form, and a copy of the applicant's valid ID card.

In addition, relevant insurance accident proof materials are required:

(The materials required for claims by each insurance company may also vary slightly, and the following are for reference only)

Medical insurance claim materials

• Part A of the medical insurance compensation application form must be correctly filled out by the insured

• Part B of the medical insurance compensation application form must be correctly filled out by the insured's attending physician

• Medical receipts

• Inspection reports (if applicable), such as surgical reports, laboratory reports, computer scans, image reports

• Other supplementary documents, such as compensation budgets/compensation details from other insurance companies (if you have applied for compensation from other insurance companies)

04. Frequently Asked Questions on Insurance and Voluntary Medical Insurance Claims in Hong Kong

Q: Can voluntary medical insurance be reimbursed at Shenzhen United Family Healthcare?

Most voluntary medical insurance in Hong Kong guarantees medical reimbursement within the Asian region. In addition, Hong Kong insurance companies have a designated list of mainland hospitals, and Shenzhen Xinfeng United Family Hospital is also included in most of the designated mainland hospital lists.

Q: Can day surgery be reimbursed for Hong Kong voluntary medical insurance?

The small surgeries performed at the hospital's day surgery center are covered by voluntary medical insurance, and the daytime surgery fees that can be claimed include operating room fees, prescription drugs taken during the surgery, etc.

Reference example: During the colonoscopy examination, the insured was found to have 2 lumps of flesh, requiring excision surgery and pathological examination. Colonoscopy examination and excision surgery are both simple surgeries, so they can be completed on the same day at day surgery centers or clinics with rehabilitation facilities. Pathological examination is also within the scope of claims, so preoperative examination, surgery, and postoperative examination are included. The entire surgical process of the patient can be carried out under the protection of voluntary medical insurance. (The above examples are hypothetical and for illustrative purposes only. For details and definitions of this coverage, please refer to the policy terms of the relevant voluntary medical insurance products.)

Q: When should I submit a claim application?

Most insurance companies require customers to submit their claims and related documents within 90 days from the day of the accident, patient undergoing day surgery/discharge, or insured person's death.

If the customer submits a claim application after 90 days, additional reasons need to be provided for the insurance company to consider.